How Highways Lead Us To Hell

Wide is the gate, and broad is the way, that leadeth to destruction, and many there be which go in thereat.

The new Saint Louis train station dumps you right under a highway, as if to say, “You took the train? Fuck you.” Saint Louis is a nice town but still terrifying coming from Sri Lanka. The cars are as big as our lorries, their back alleys are as big as our main roads, and their main streets are as big as our expressways. Don’t get me started on their highways. They have more lanes than I can count. Everything is bigger and none of this looks remotely sustainable at all. As the Bible said ‘wide is the gate and broad is the way that leads to destruction.’ Or as AC/DC put it ‘I’m on the highway to hell!’

So is any of this sustainable? No. Charles Marohn of the ambitiously (delusionally?) named Strongtowns organization says “we have grown to understand that the underlying financing mechanisms of the suburban era operate like a classic pyramid scheme, with ever-increasing rates of growth necessary to sustain the accumulation of long-term liabilities.”

As I’ve said:

Every road is actually a long-term liability, and cities don’t raise nearly enough money from taxes to pay for them. Instead they take money from new projects to pay for maintenance on the old, just kicking the can down the literal road. And we’re rapidly nearing the end of the road.

If you thought the housing collapse was fun, wait for the roads collapse. In this case actual tunnels and bridges will fall down.

I think of this as I take the train — which is now parked near the metaphorical bins of St. Louis — while car culture dominates all. Broad is the way and narrow is the rail gateway to St. Louis now.

I do not call Strongtowns delusional in a dismissive way. Far from it, they have done the yeoman work to actually calculate what maintaining roads like this cost, and calculating that it simply cannot be done. They cite from multiple examples, summarized as follows:

We began to collect hard numbers from actual projects and compare those costs to the revenue generated by the underlying development pattern. This work continues, but in every instance we have studied so far, there is a tremendous gap in the long-term finances once the full life-cycle cost of the public obligations are factored in. Without a dramatic shift of household and business resources from things like food, energy, transportation, health care, education, etc… and into infrastructure maintenance, we do not have even a fraction of the money necessary to maintain our basic infrastructure systems.

I simply say that the Strongtowns name is delusional. Americans fundamentally want to ‘solve’ predicaments, which is a category error. Sometimes you’re just fucked. American towns are weak and a hopeful name will not change a predicament into a problem.

The very reasons that Strongtowns documents for the car-city’s collapse (“it’s too expensive!”) are the reasons the car-city can never change (“it’s too expensive!”) It’s the sunk-cost fallacy writ large. Americans have simply invested too much publicly in roads and too much privately in cars to ever turn around. The system will just keep going until the bridges fall down and the oil runs out. Chuck puts the problem simply when he says:

The great American experiment in suburban development entices communities to take on long-term liabilities in exchange for near-term cash advantages (see Part 1). But as those liabilities cost the community more than the development creates in overall wealth, the approach ultimately results in insolvency (see Part 2). To forestall the day of reckoning, more growth is induced, setting up a Ponzi scheme scenario where revenue from new development is used to pay liabilities associated with old development (see Part 3). This is unsustainable, but that has not kept us from trying desperately to keep it all going.

What I think he misses is what Aboriginal thinker Tyson Yunckaporta observes when he says, “it really is not possible to maintain massive nations and cities in any sustainable form.” This is both undeniably true in the long-term and completely denied in the short. Such is ‘The Physical Impossibility of Death in the Mind of Someone Living,’ as Damien Hirst puts it. This should be familiar to anyone that has ever hit a SNOOZE button.

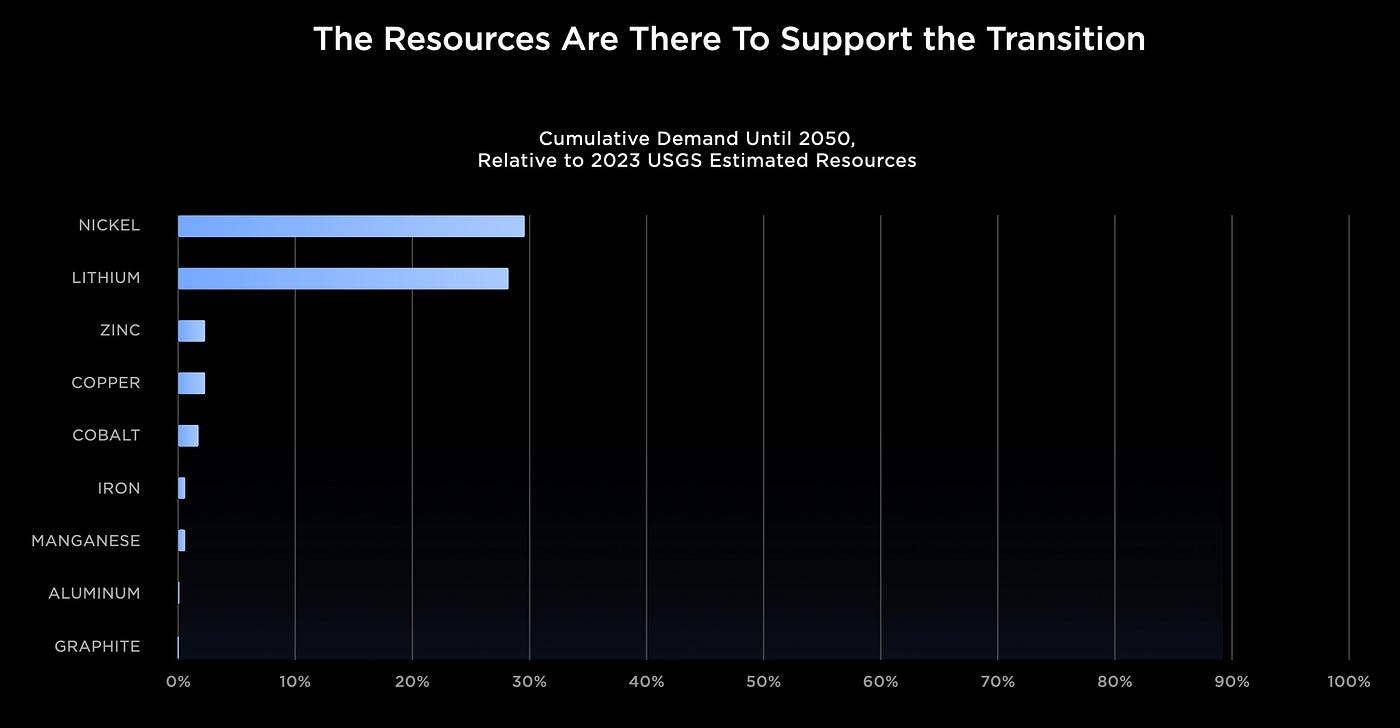

Cities like St. Louis (or really any car-centric city) keeping hitting the SNOOZE button by paying for old maintenance with new growth, or just not maintaining things at all. I’m walking on the sidewalk like a latter-day leper and the slabs have already gone tectonic, making walking difficult and wheelchairs impossible. As the world runs out of fossil fuels (which are simply not renewable in the long run) how can such sprawled cities be maintained anyways. Electric cars? OK. If we use up a generous 30% of lithium reserves to build out the first generation of cars, that doesn’t look like a thousand-year civilization to me. Just looks like a drug addict switching drugs. Take Tesla’s presentation on the subject:

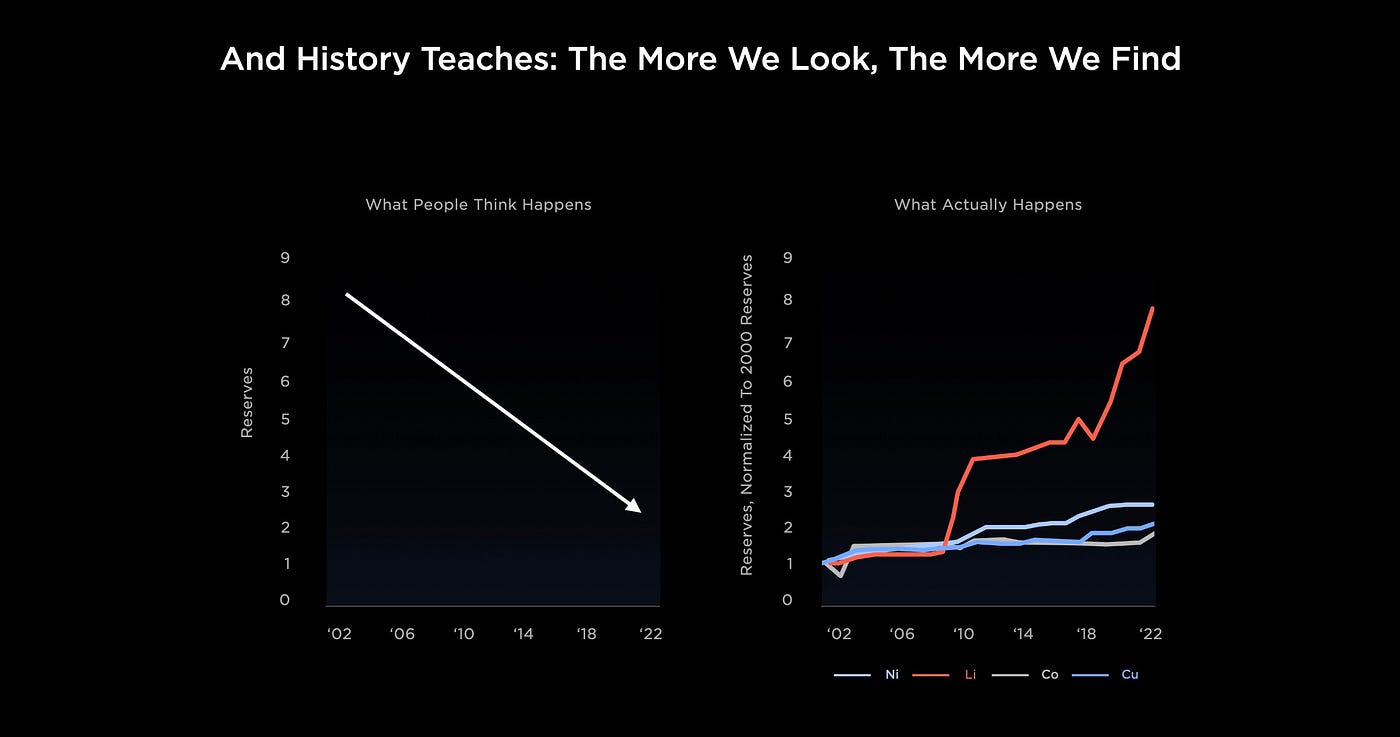

Tesla acknowledges that we would use up ⅓ of known (ie, economical) resources to just get us to 2050. Then what? Then what? Tesla’s answer to this important question is pure faith:

The answer to ‘how much cocaine is at this party?’ is simply not ‘infinity, because I’m high as fuck right now.’ There’s no long-term thinking here, it’s just a long con. The first rule of investment is that past performance is not indicative of future returns and yet Tesla puts out investor decks that just say everything will go up and to the right forever. This isn’t long-term thinking, it’s a long con.

If you attempt to walk in any car-centric city, you realize that what fuel goes into the car is only one part of the problem. The land use alone is hideous. The sheer amount of pavement turns the city into a giant stone griddle. It is hot as fuck and there’s no shade because they cut all the trees down. People AC their houses and cars to escape the heat, which then pumps more hot air onto the streets, turning the whole place into a convection oven.

It’s a Ponzi! It’s all a Ponzi! but saying this doesn’t actually help anyone. Calling out a Ponzi doesn’t actually ‘solve’ the problem. It just makes it collapse. This is because Ponzi schemes — by the time you identify them — are predicaments, which do not have solutions. The category error I was talking above. The sad fact is that anyone trying to ‘help’ with this situation does not understand the situation. People like Chuck Marohn are doing their dharma and more power to them, but the fact is that the karma of cars is inexorable.

As the Bible says, “Every tree that bringeth not forth good fruit is hewn down, and cast into the fire.” This is what I think as I’m broasting on the streets of St. Louis, walking towards the old Route 66 to find a new marijuana dispensary. Only mad dogs and Sri Lankans are out in this heat. This city is fundamentally unlivable, as every city built around cars will inevitably be for human beings. Wide is the gate and broad is the highway to hell, and we’re on it. People would know if they just stepped out of their cars for a minute. As St. Louis’s poet laureate Nelly said, “It’s getting hot in herre!”