How China Could Re-Dollarize The World

China issued a US dollar bond in Saudi Arabia, striking at the heart of the petrodollar. This was a negligible bond issue, $2 billion, but what's interesting is the rate and the uptake. China was able to issue US denominated bonds at basically the same rate as the US, they're almost as good as 'gilt'. This is not de-dollarization, but re-dollarization, using USD to subvert the USA.

The Bond Issue

For reference, when Sri Lanka issued USD bonds in 2022 they traded at a roughly 9% premium (very high risk). When Alibaba issued USD bonds in 2017 they traded at 1.08% above the rate (medium risk). When China issued bonds last week, however, they traded at only 0.007-0.029% above the rate (3Y/5Y), and were oversubscribed by 19.9x. As one Chinese commentator put it (via Eric Yeung), “we replaced the Federal Reserve.” Not quite, but you can see a Novus ordo seclorum taking shape.

The Money Issue

In the film Scarface, once Scarface started making lots of money, he had another problem. What to do with it? This is the problem OPEC countries faced in the aftermath of the 1970s Oil Shock. After nationalizing their oil, they were suddenly making billions of dollars in oil revenue, and had no clue what to do with it. Until the colonial countries that tried just stealing the oil reached a cunning compromise. They would let the petrostates make their money, as long as they parked it in western banks.

Ideally (and ideologically) that money should have gone into other developing countries, but greed was greater than solidarity. As Glenn Gray wrote, “put simply, the oil producers did not want to bear the risk of pouring their earnings directly into developing countries.” Instead, “when the oil exporters began to shift from short-term bank deposits to medium-term bond purchases, they favoured the industrial nations by a huge margin: France, Japan, the US and even (unwisely) Britain.”

OPEC put their money right back in the 'white' banks and slowly got recolonized the sneaky way. Now OPEC is headquartered in Europe and most of its founding nations have been couped, invaded, sanctioned, or occupied militarily. What oil-producing nations discovered was that, while they might control the oil, if they didn't control the money, they didn't control shit.

What happened then was an unwritten deal between the US (as the colonial heir) and Saudi Arabia (as the most petro of states). The US would let them make their money, as long as it was US money. The Saudi is not a real currency, it's been pegged to the US dollar since the 80s. People say the US dollar is a fiat currency (meaning basically made up) but it's not. It's backed by oil. That's why it's called the petrodollar. And that's what makes the symbolism of a Chinese bond issue in Saudi Arabia so great. Saudi Arabia was the heart of the petrodollar, and China is showing that it can beat to a different drummer entirely.

An Illustration

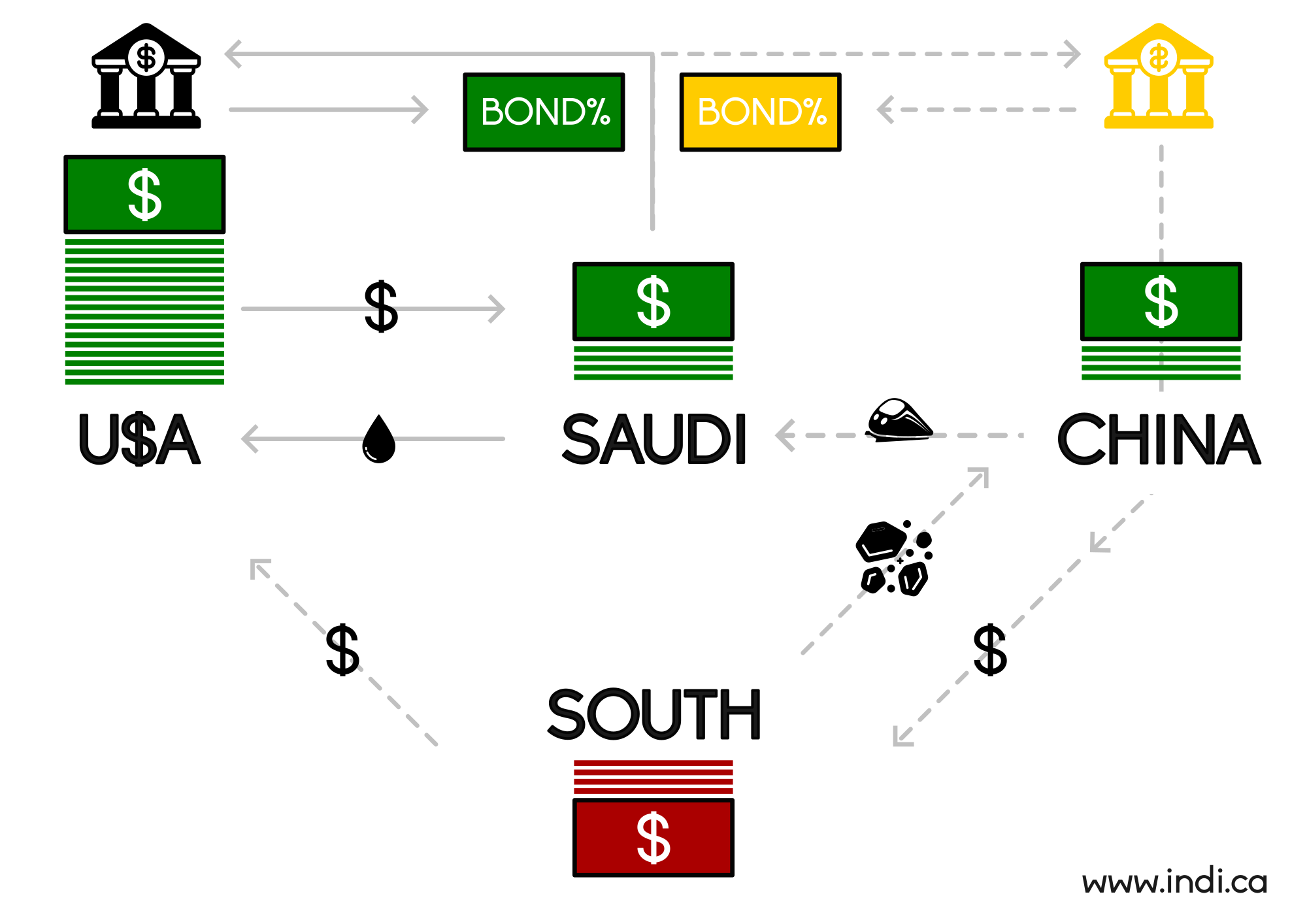

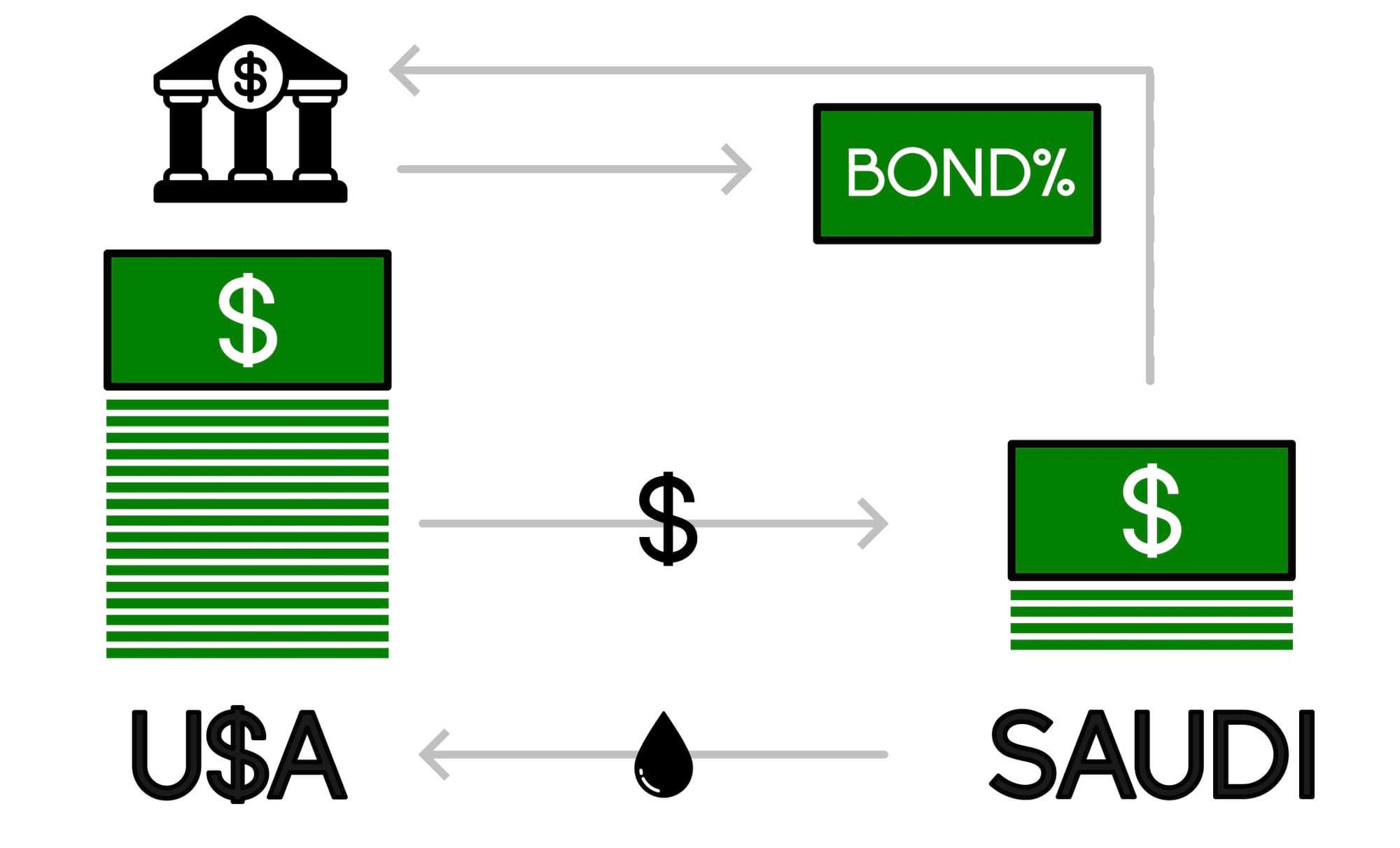

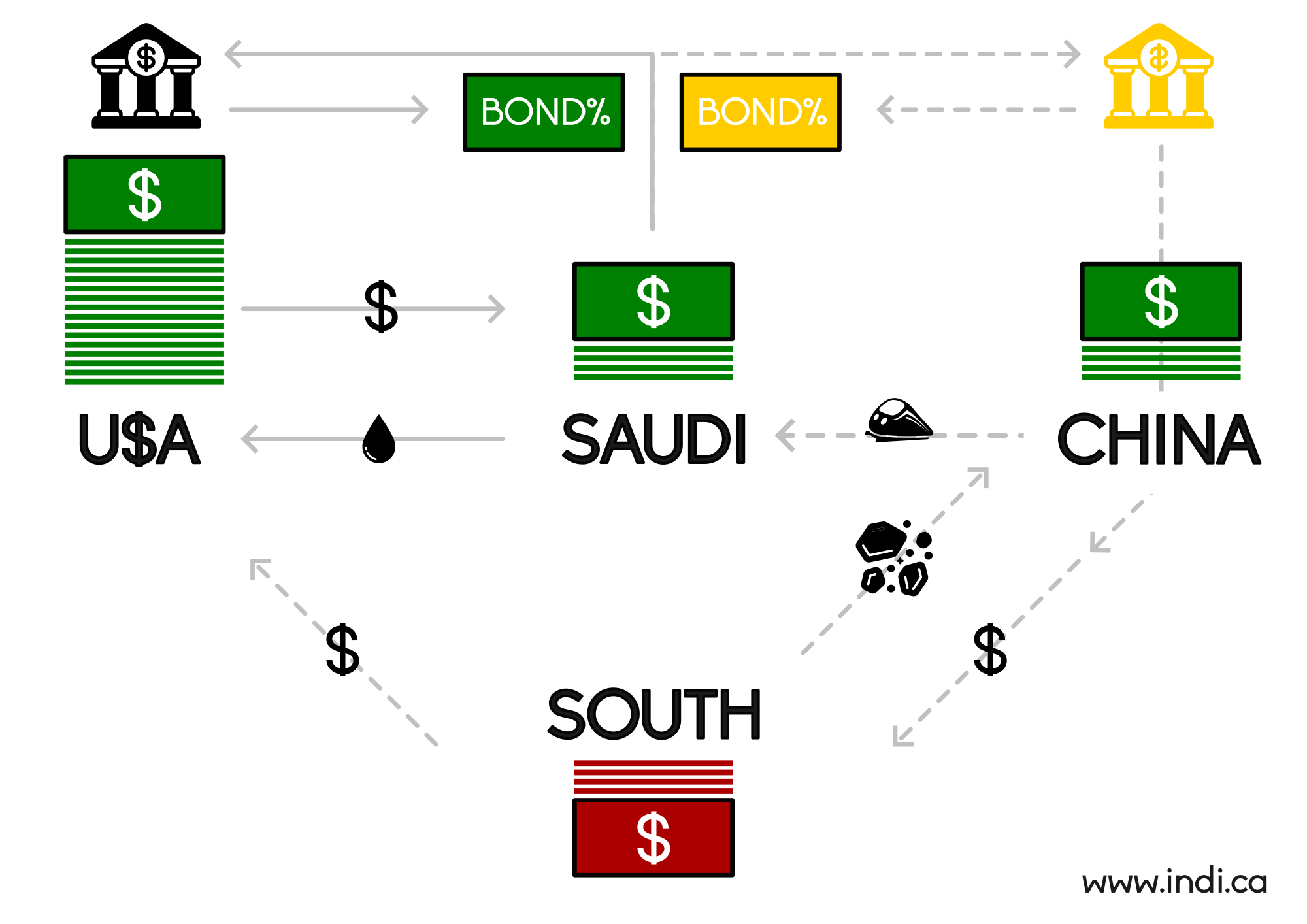

As an illustration of what this bond issue did and could do, we'll zoom in on the inscrutable illustration from above. This is what (extremely simplified) trade looks like between the USA and Saudi Arabia.

Oldus Order Seclorum

Saudi sells oil to the USA, which pays for it in USD. Saudi doesn't know what to do with this USD, so it buys US Treasuries (called a bond here), to earn some interest. This is how the devil gets you. On the interest rate. Remember that the White Empire has two traps, the Debt Trap for poor countries, and the Asset Trap for the rich. Saudi is in the latter, no matter how much they twist. They may control their oil, but the US Central Bank ultimately holds their money, and that's where the real power is.

This system works fine as long as A) the House of Saud trusts the US to hold their money and B) USD buys guns and technology they need. Today, however, both conditions have changed. America has weaponized their currency and crashed their weaponry. America has sanctioned Russia and lost to Russian weapons in the field. America has sanctioned Yemen and lost to them in the Red Sea. Nevermind Afghanistan and all the historical Ls they've taken. The most expensive weapons in the world won't even subdue the poorest people.

America has broken the stick and eaten the carrot, it's actually unclear what's motivating anyone to follow them besides sheer inertia. America doesn't make anything worth buying, and their weapons are only good for slaughtering defenseless women and children. US weapons—even if they were even available—look shoddy, and their currency looks shady. Why should anyone buy into this thing?

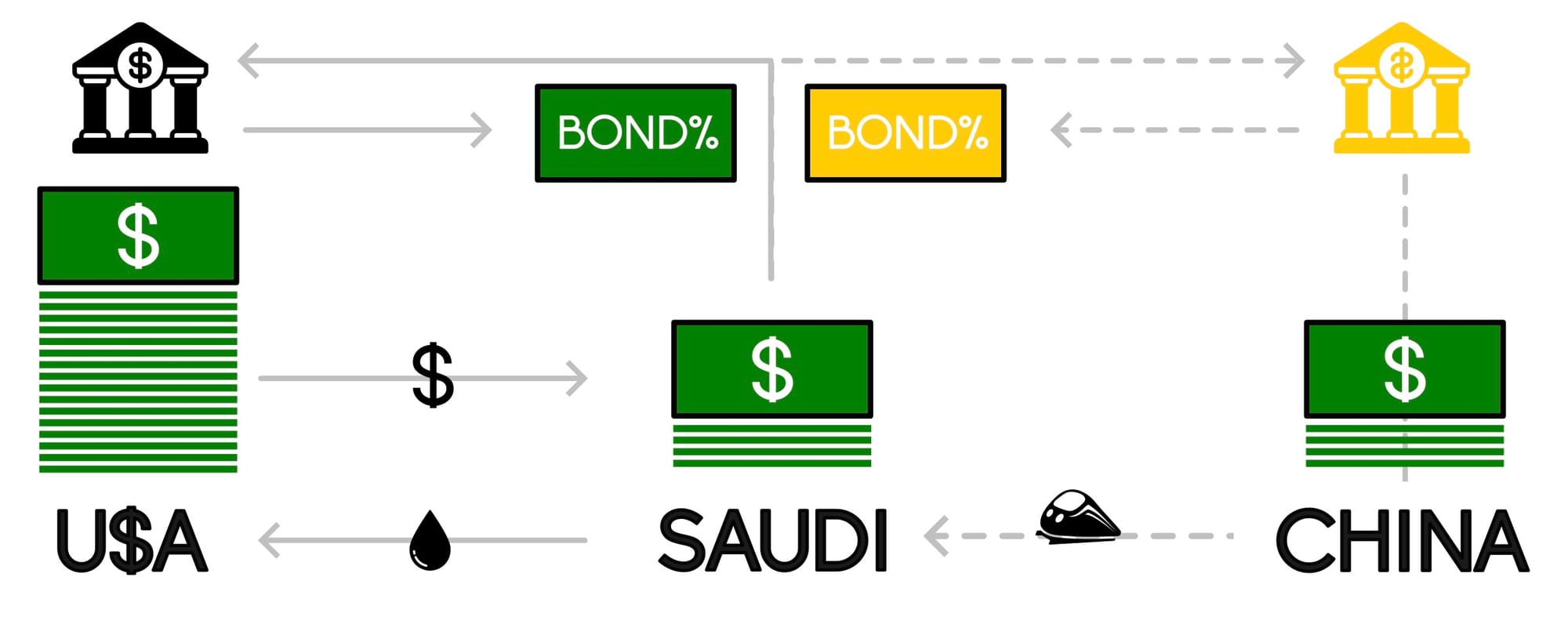

Novus ordo seclorum

The answer—for people that haven't been kicked out already—is TINA. There Is No Alternative, as Margaret Thatcher said. But kicking Russia out of this system has been a huge self-own, because it showed a clear alternative. Russia has not only survived, they have prospered outside of the US financial system (now exceeding Germany and Japan in GDP terms). Because Russia is so big and so real economy rich, everyone else (including the US, lol) has continued dealing with them. Seeing this (and the writing on the wall) China is working on its own exit plan, before it's too late. Note that none of these people especially wanted to de-dollarize, America is just making them. In that vein you can see the Chinese-Saudi-USD bond issue as an experiment. What if, instead of de-dollarizing, we re-dollarized. Keep the dollars but ditched the United States. What would that look like?

Well, a bit like this,

This is a reserve system with two reserve banks. In this (hypothetical) system, Saudi has a choice. They can bank their dollars with the increasingly deranged US or with increasingly powerful China. Then, instead of taking payment in dollars, they simply use the dollars as scrip to get stuff they actually want, like trains, and military equipment that can be delivered in less than a decade. If you take this tiny $2 billion issue as a test of the hypothesis, it half works. At least on a small scale. China was able to issue a USD bond at basically the same same rate as the US Central Bank, with 20x as much money waiting to get in.

New world order

Now we'll get even more theoretical. What about the rest of the world? Remember that the original sin of OPEC was forgetting their colonized brethren, and that they got recolonized after their little rebellion. How could China go all the way, to financial liberation?

For this, I'll rely a bit on speculation from Chinese netperson Pingyuan Gongzi via Twitter. I have auto-translated this, so take it with salt and chili, any errors are mine and the algorithms. Pingyuan Gongzi proposed the following:

The specific process of this matter can be simplified as follows: we borrow US dollars from Saudi Arabia and then “give” them to a third country. The third country repays the US debt and gives us resources. We give Saudi Arabia high-tech products. The US dollars from the third world are accelerated to flow back to the United States, and the US dollar inflation, in turn, accelerates Saudi Arabia's “borrowing” of US dollars... forming a perfect cycle. Saudi Arabia sells dollars, we get resources, third world countries pay back U.S. debts, Saudi Arabia gets high-tech products, and the United States “gets” dollars... It's a win-win situation for all parties, and the whole world wins.

We have turned the U.S. dollar into an “underlying asset” rather than an actual currency. Today, we trade with many countries sanctioned by the United States in this way - give me $10 million of oil, and then give you $10 million of industrial products. The U.S. dollar is just a pricing tool, and it seems as if it is involved but not involved.

To eliminate “dollar hegemony”, it is not necessary to eliminate the US dollar. We can also make the US dollar an unnecessary unit of account.

The reason why this was accomplished is, first of all, because China is the world's factory. Only China can produce industrial products and high-tech products that others cannot buy from the United States and Europe. Secondly, China has a strong ability to maintain a trade surplus. It always has a lot of US dollars in its hands. Whoever has more US dollars is the “Federal Reserve”; finally, it is because China has abundant martial virtues. If another country “helped the United States issue US debt”, the US aircraft carrier formation would have come to the door long ago... However, in front of China, the United States also has to [stand] clear.

This is a fascinating idea, echoed by ‘Chige Chats About Finance’ on Toutiao:

From Toutiao account @Chige Chats About Finance”, subtitled by Eric Yeung

I've used their speculation to fill out the infographic here:

As you can see, rather than take the traditional path we discussed (recycling dollars into America), instead of taking the less traditional path of recycling dollars into China (which also doesn't want them), this model recycles the dollars into the Global South. Then the Global South countries give them back to America, and the cycle (and spell) is broken. This could theoretically have the effect of the world being able to trade and invest in dollars without financing America's wars on the world. I think to myself, as Louis Armstrong said, what a wonderful world.

This is, of course, a lot to extrapolate from a single bond issue worth maybe a few days of bombing. But there's a lot going on these end days. Wars, trade wars, rumors of war, and a Greater Depression in the wings. At the same time, everything we call 'the economy' is just a draw on the environment, which is collapsing atop all of us, sinner and sinned against. Everyone is selling bonds against a future that doesn't exist, America, China, everybody.

Everyone's playing hot potato with a dollar that no one wants to be left holding, but the planet is turning into an oven anyways. It's cold comfort in these hot times, watching either the de-dollarization of the world, or its re-dollarization into something else. We know that the Empire won't stop killing until it's unable to make a killing, but what's the point of being liberated into a wasteland? They said the meek would inherit the Earth, but They didn't say what shape it'd be in. As much as I long to see the White Empire burn, what comfort is vengeance when the planet is already dead? Some comfort. Some. At least we can see the colonizers go broke before it all breaks.